Plan for the Financial Catastrophe that is Divorce

A “gray divorce” is when adults ages 50 or over get divorced. According to data from the National Center for Health Statistics and the U.S. Census Bureau, the divorce rate for those 50 and up has doubled since the 1990s and tripled for those 65 and older since 1990.

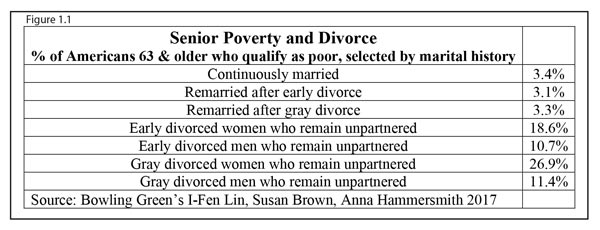

Divorce, no matter what the age, is often an emotional and financial crisis. A major longitudinal survey was conducted on 20,000 Americans born before 1960, by I-Fen Lin, Anna Hammersmith, and Susan Brown. Susan is the co-director of the Bowling Green University National Center for Family & Marriage Research. For women who divorce after age 50, their standard of living plunges by 45%, which is double the decline for younger divorced women. Older men see a 21% drop in their standard of living after a gray divorce. In virtually all states, one loses half of all assets after a long-term divorce, absent a very strong prenuptial agreement. When Brown and her colleagues surveyed those for up to a decade post-divorce, “There is no appreciable recovery on the wealth front ... and in standard of living”.

(see figure 1.1)

At least 40-50% of first marriages wind up in divorce and a higher percentage of 2nd and 3rd marriages wind up in divorce. There are complex emotional, lifestyle, and financial factors that cause divorce. The financial consequences are so serious that one should go through lengthy counseling before divorce. One should also preserve assets by going through mediation instead of hiring 2 sets of attorneys who motivate you to fight for years with huge legal fees.

However, do hire a CPA or some impartial financial analyst to make sure all the assets are counted and that it’s the net after-tax assets that are divided equally. Getting half of his $1 million 401k, which is taxed as ordinary income rates when funds are withdrawn is not the same as receiving the $500,000 free and clear house.

Now that you are getting a gray divorce, how do you still have a future comfort-able retirement when you are now 50, 55, or even 65 years old?

• Plan on working at least 5-10 years later than originally planned so that you can add to your retirement nest egg.

• Don’t take your Social Security retirement benefits until age 70, where it may be up to double what it would be at age 62. Note that only 3% wait until age 70.

• Be very realistic about your expenses now that you’re single. If your ex-wife chooses to keep the $500,000 house, she may become house rich and cash poor. As the ex-husband, it probably does not make sense for you to buy another $500,000 house when you are only 5-15 years from retirement.

• Maximize the retirement cash flow from your share of the financial assets. If you deposit funds in a private pension fund and can wait 5-10 years, you may get triple the annual income compared to the bank, bonds, or stock dividends.

• Minimize your investment risk. You just lost half your financial assets due to divorce and can’t afford to lose 25-50% in the next stock market crash.

• Find a life partner to live with but think very hard before getting formally married again. It really is cheaper for two to live together than separately.

Dr. Harold Wong earned his Ph.D. in Economics at the University of California/ Berkeley and has appeared on over 400 TV/radio programs.

Contact Dr. Harold Wong at (480) 706-0177 or

For more information on how Dr. Wong’s methods that are indeed different from most other financial advisors, though DO WORK when it comes to saving taxes while creating wealth for your retirement, CLICK HERE to set up a phone appointment with Dr. Wong. There’s no obligation or strong-arm sales, we promise!

Office Address

90 South Kyrene Rd

(Says Suite 1 on the front door)

Chandler, Arizona 85226

Click here to schedule a FREE Strategy Session

with Dr. Wong